If you’re a regular reader of this blog, you know that my advice tends to lean to the conservative side: don’t ever borrow as much as your lender is willing to give you, don’t over-pay for a home unless you plan to die in it, don’t get emotional in a bidding war, assume the worst for closing costs, blah, blah, blah. I’m also a huge fan of PAYING DOWN YOUR MORTGAGE EARLY. Here’s why:

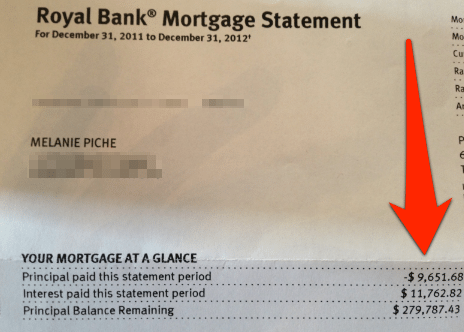

1. Pay Down Your Principal Balance. Your mortgage payment is made up of 2 amounts: interest + payment towards the principal or outstanding balance of your mortgage. If you are in the first years of your mortgage or the equity in your house isn’t very high, you are likely paying MORE towards interest than principal. Even if you have decent equity in your house, a lot of your payment goes towards paying interest. Case in point: my mortgage in 2012:

Ouch! So for every $1 regular mortgage payment I make every month, more than half of it just goes to the bank! But for every $1 extra payment I make on my mortgage, $1 goes to repaying the principal. Nice! Of course I practice what I preach, so I make extra payments on my mortgage every single month. Where else can I get that kind of return on my money?

To make this strategy work for you, start by checking the terms of your mortgage. Many mortgage products will allow you to double up your payments every month and make one annual lump sum payment of up to 10% of the principal without any penalty. Depending on your lender, you can likely automatically increase your monthly mortgage payment so you won’t even notice it. And if you get a bonus, inheritance or win the lottery, you can make a lump sum payment to reduce your principal balance even more.

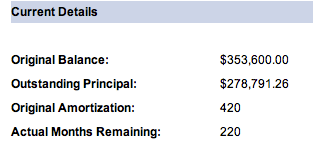

2. Reduce the number of years left on your mortgage. When I first got my mortgage 4 years ago, the 35-year mortgage was alive and well. By systematically over-paying my mortgage every month and making two lump sum payments, I’ve managed to reduce the number of months remaining on my mortgage to 18 years instead of 31. Boom! I can think of a lot of other things I’d like to do in years 18 through 31 with the money that currently goes towards paying my mortgage (Tahiti maybe?)

3. More Equity in your Home = More Protection From the Unknown. We’ve all watched the housing disaster in the US and we now know that if prices go down, you better hope that you don’t owe more than your house is now worth. Pre-paying your mortgage allows you to build equity in your home and shields you from unknown economic events, housing downturns and increased interest rates.

So should you pre-pay your mortgage? ABSOLUTELY. In fact, I’d encourage you to call your lender and do it right now.

Josh Rachlis says:

Just today I was thinking about doing exactly what you’re saying. Putting in as much as I can. The one thing I’m wondering is whether it makes more sense to keep any extra money and invest it in stocks. If I can put, say, $10,000 into stocks and make, say, 20% a year by investing, maybe that makes more sense than throwing the extra 10 grand at the mortgage, which is something like 3%? I dunno. In any case, I’d love to have lots of extra money so I could stop having to make mortgage payments altogether. Any get rich quick ideas? 🙂

Melanie Piche says:

Where are you making 20% a year investing? I want in on that deal! 🙂

Lowrey Cain says:

Me too Josh, let’s invest with Mel! I keep some money aside for repairs and maintenance and usually pay down on my anniversary.

FROOTS says:

As a fellow fiscal conservative, here are some other basic points to consider when making this decision:

1) Risk: If you invest your money in securities that can earn higher returns, there will usually be a certain amount of risk involved. Paying down your mortage or consumer debt to save interest expense is a sure thing.

2) Taxes: If you save $1,000 of interest expense by paying down your debt, that’s an extrra $1,000 in your pocket. If you earn $1,000 of income from your investments, you generally have to pay some taxes.

Melanie Piche says:

Good points Froots! Thanks for sharing!

Brendan Powell says:

As long as you have a buffer of some sort! Credit line, cash reserve, etc…

Money you prepay on your mortgage is a bit harder to get back if you need it (which is one of the advantages!) so if you need a new roof all of a sudden, it’s good to have something liquid in say a TFSA

Got a plan B? Then hit that mortgage