What’s one thing we know for sure? No amount of snow or cold temperatures or lockdowns are going to temper the appetite of Toronto home buyers. In fact, the Toronto real estate market is as hot as we’ve ever seen it (and we’ve seen a lot).

If you’re in the market to buy a home, here’s what you need to know about what’s going on so you can be prepared:

We’ve Never Had So Little Inventory of Homes for Sale in Toronto

Every year, we see the same thing in January: tons of buyers who are ready and motivated to buy and sellers who are waiting to list their homes later in the spring.

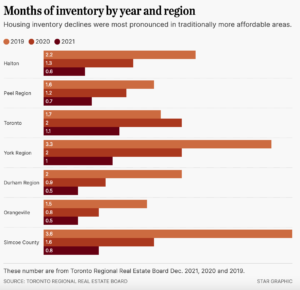

This year, we have an even bigger inventory problem, with listings down 60% in December 2021 vs December 2020.

Interest Rates Are Going Up

After a few years of rock-bottom interest rates, 2022 will undoubtedly see interest rates rise. In fact, some experts predict we’ll see a series of three to six rate increases from the Bank of Canada this year. With inflation at levels not seen in more than 30 years, the feds are eager to cool the market (especially the real estate market).

Pro Tip: While you can’t control what happens to interest rates, you can make sure that you’re locked into a rate that you’re happy with. Ask your lender to put your pre-approval in writing and give you a rate guarantee (they’re usually good for 90 days).

But Don’t Get Excited…Higher Interest Rates Don’t Mean Prices Are Going To Decrease

When interest rates rise, we normally see 3 things:

- A rush of buyers trying to buy a home before their pre-approval runs out, resulting in greater short-term demand, fueling even more competitive bidding wars, especially with first-time buyers.

- Some Sellers are pushed to list their homes for sale sooner vs later, which will help ease the inventory problem – but the imbalance of power between buyers and sellers remains. Remember: most sellers are buyers too, so when they sell, they also enter the market to buy..

- Buyers who were already at the top of their budget have to compromise and buy a smaller home, or in an area inferior to where they were searching – but they don’t just disappear from the market.

An interest rate hike is meant to cool the market by tempering demand, but it does nothing to solve the inventory problem. The result? Prices continue to increase, but not as fast.

Offers: If You’re In It, Be In It To Win It

When there are too many buyers chasing too few houses or condos, bidding wars result; and when the imbalance is as great as what we’re seeing right now, those bidding wars can be fierce.

Adding fuel to the fire: people who can’t afford a particular house but make an offer ‘just in case’ – we call those ‘throwaway offers’. And those throwaway offers propel prices to even higher levels, often pricing those very buyers out of the neighbourhoods they want to buy in. Here’s how it happens:

- A house is listed at $899K

- Last week, a similar home one street over sold for $1.1 million.

- 5 Buyers REALLY want that house. They have the mojo and the budgets to compete and make compelling offers.

- 5 other Buyers also really want that house, but they have more restrictive budgets or don’t want to pay “too much above asking”. Some bid around the asking price and others bid under the sold price of the comparable home.

- 1 super motivated Buyer has lost out on their last 3 bidding wars and desperately wants that house.

- With 5 other offers on the table, the super-motivated Buyer might bid $1,150,000. With 10 other offers? They bid $1.2 million and win the house.

Pro Tip: If you can’t REALLY compete, don’t make an offer. You’re hurting yourself in the long run. If you CAN compete, be in it to win it.

Pro Tip #2: Work with a local agent who understands the market conditions and can guide you accordingly. Knowing what you can’t afford is just as important as knowing what you can afford.

Click here to read more of our tips about How to Win a Bidding War.

Timing is Everything

The market is moving incredibly fast and if you’re a home buyer right now, you need to be ready to move. That means:

- Making sure you’ve clearly outlined your must-haves and must-have-nots so you can focus your search (and make sure you’re on the same page as your spouse)

- Researching your target neighbourhoods and schools

- Hiring the right agent; someone who is:

- Available and responsive, with a flexible schedule to see properties on short notice (or works with a team who can coordinate to make sure you see that new listing asap)

- Obsessively watching new listings and sales in real time

- Has experience and success navigating in this kind of aggressively competitive market

- Has access to off-market opportunities and exclusive listings not on the MLS

- Having your financing in order and working with a lender who can give you the confidence to make an offer without a financing condition

- Having quick access to a deposit (usually 5% of the purchase price, delivered with the offer or within 24 hours). If your deposit isn’t liquid, talk to your lender about other options.

- Being flexible with when you see properties vs waiting for the weekend

- Being ready to make a quick decision

A fast-moving market doesn’t mean you don’t get to do normal due diligence – it just means you have to do a lot of it in advance. It also means you should be prepared to be decisive.

This Is The Time Of Year When New Benchmark Prices Are Set…BUT It Won’t Be Like This All Year

January to March are the most competitive months to buy a home, so if you can’t stomach competing with 10 or 20 offers, you might want to pause your search until more homes come on the market in the spring. BUT…and this is an important BUT…the prices of those homes will be based on the sales that are happening right now, so don’t expect prices to decrease. They’ll just be increasing at a slower rate.

The Cost of Waiting

Over the years, we’ve seen so many buyers choose to ‘wait’ in the hopes that prices decrease. It’s never worked. It’s nearly impossible to save money faster than prices are increasing in Toronto, and when you factor in changing interest rates, it can get expensive fast.

In 2020, we wrote a blog about how much it cost to buy in 2020 vs 2018, and it was a whopping $252,473 more. You can read the blog here: Waiting to Buy

Being a home buyer in Toronto is never easy, but it’s even harder at this time of the year. Know what you want, work with the right agent and remember: timing the market is impossible. Do what’s right for you now.