— We take our content seriously. This article was written by a real person at BREL.

With a few interest rate reductions under our belt and more predicted in the next 12 months, a lot of Canadians are wondering: Should I buy a home now or wait until rates come down further?

What Happens to Mortgage Payments When Rates Go Down

Every 0.25% decrease in the interest rate drops your payment by around $12 per month for every $100,000 in mortgage. (assuming the mortgage is amortized over 25 years and paid monthly).

Let’s look at an example:

You’re buying a $1,000,000 home, with a 20% downpayment and a 25-year amortization. Here’s how your monthly mortgage payment changes on an $800,000 mortgage, as the interest rate decreases:

| Interest Rate | Monthly Payment on $800K Mortgage |

| 5.00% | $4,643 |

| 4.75% | $4,540 |

| 4.50% | $4,428 |

| 4.25% | $4,317 |

| 4.0% | $4,208 |

| 3.75% | $4,100 |

| 3.50% | $3,994 |

During a 3-year term, your total payments would equal $163,440 at a 4.75% interest rate. At 4%, you’d pay a total of $151,488. That’s a savings of $11,952 over the 3 years!

Almost $12,000 in interest savings isn’t insignificant – you could spend that money on a trip, a new roof or new appliances. $12,000 is also about 1% of the price of an average house in Toronto right now. So the big question is….

….will prices increase more than 1% in the time it takes the interest rate to fall 0.75%?

What Happens to Prices When Interest Rates Go Down

Between March 2022 and July 2023, the Bank of Canada (BoC) increased the overnight rate 10 times, from 0.25% to 5%.

Reminder: The overnight rate is the rate at which banks lend money to each other, which they then use to lend to consumers. The prime rate is based on the overnight rate, and is the annual interest rate banks use to set interest rates for variable loans and lines of credit, including variable-rate mortgages and investments. The actual interest rate paid by consumers is tied to the prime rate and varies depending on a borrower’s solvency (ie credit rating and financial situation) and the bank’s goals (ie attract more mortgages or more investments).

As rates increased, we saw more homes for sale, fewer motivated buyers and lower sales. The result? Lower prices.

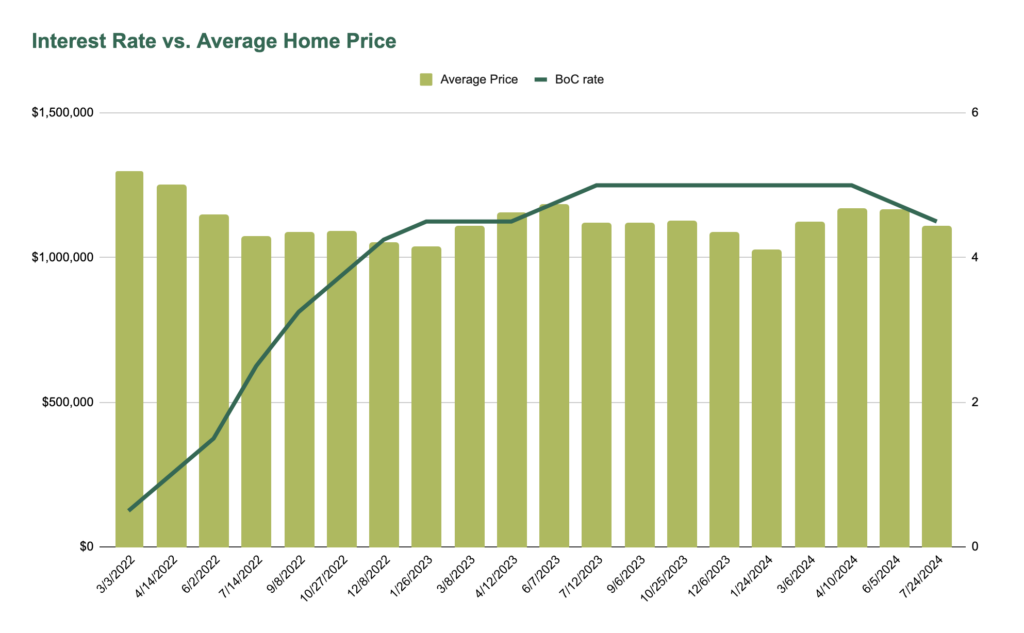

Interest rates have a lagging effect – meaning we only notice the impact of a change after a few months. I plotted the average price of a home in the GTA with the BoC’s overnight interest rate to see what happened to prices while rates were being increased:

No surprise: we see prices moving in the opposite direction to interest rates:

- The highest average price of $1,298,705 was reached in March 2022 – when the BoC rate was increased for the first time.

- The lowest average price of $1,025,262 happened in January 2024, four months after the BoC reached its peak rate of 5%.

As interest rates increased, the average price of a home in the GTA decreased by 21%.

I’d love to demonstrate what happened to prices the last time rates were repeatedly decreased, but that was in 2020 – and there was a lot more going on than just rate changes. Economic models weren’t built to withstand pandemics.

6 Important Things To Know If You’re Debating Buying Now vs. Waiting for Rates to Come Down

1. We’ll not likely ever see pandemic-era interest rates again.

The buyers who were lucky enough to take advantage of those 1% rates probably didn’t appreciate how truly once-in-a-lifetime those rates were. If you’re waiting for interest rates to fall below 3%, you’ll probably be waiting a long time – maybe forever.

2. In the last 20 years, the average price of a home in Toronto increased by $788,857 – more than 200%.

That’s an average increase of 12.5% per year. While overall affordability constraints likely mean we won’t see those kinds of increases again, it stands to reason that home prices will increase faster than interest rate savings.

3. There’s a lot of pent-up demand.

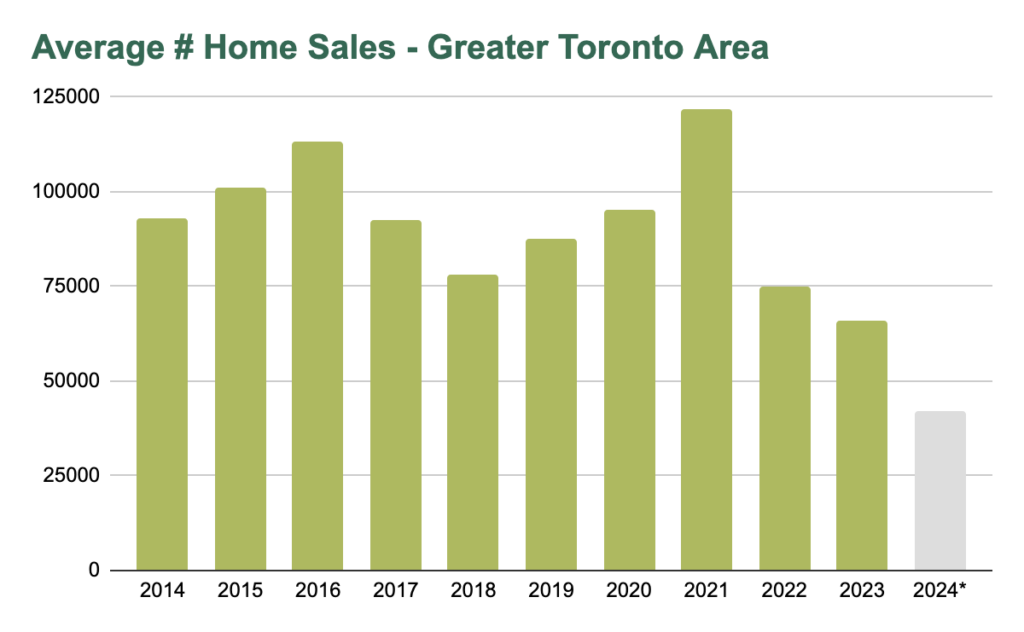

Over the last 10 years, Toronto has seen on average, 92,000 homes sold per year. As you can see from the chart below, a lot of homebuyers put their searches on hold as interest rates were increasing, with only 65,688 homes sold in 2023. The 2024 sales numbers for the first 7 months of the year also reflect significantly lower volume than usual.

* YTD – January-July 2024

Economists have predicted that it will take a full 1% cut to interest rates to spur buyers into action. And with 2 rate cuts behind us and another imminent on September 4th, we’re likely on the cusp of a much more active real estate market.

4. You Date the Interest Rate, You Marry the Price

Mortgage brokers and REALTORS love this quote – because it’s true.

In Canada, an interest rate only impacts you for the length of the term of the mortgage, usually 3-5 years – and then you have to renew your mortgage at the going rates. You aren’t committed to that interest rate for life – you’re just committed to it for the length of the term. It’s like a long date.

But the price you pay for your home stays with you for the whole time you live there – you don’t get to renegotiate it if prices go up or down. It’s like marriage – a one-time decision.

I moved to Toronto in 1996, the year one of my friends bought a detached house in Leslieville. At the time, the BoC rate was 5%, the prime rate was 8.25% and the average cost of a home in Toronto was $198,150. In the early years, her mortgage payments were higher than she wanted them to be – but 5 years later, when she renewed her mortgage, the average price of a home had climbed to $298,450. She was happy she hadn’t waited for interest rates to drop before buying -if she hadn’t bought when she did, she would have quickly been priced out of the market.

See? She dated the interest rate….but she married the price.

(If you’re curious about what happened next…when she renewed in 2001, the prime rate was down to 7%, so her monthly payment decreased too. Because she’s smart, she held onto that house and it’s now worth more than $1.3 million. And now she’s mortgage-free!)

5. The Sweet Spot is Coming (it may already be here)

There’s a magical time in the real estate market where interest rates aren’t too punishing and prices haven’t yet started to climb too much. I call it the sweet spot. It’s the moment before all the buyers feel confident and rush to buy at the same time. It’s the moment before bidding wars go bonkers. It’s the time before prices go up.

The problem with the sweet spot is we never know when it’s happening – we only know when it’s passed.

6. The Right Time to Buy is When it’s Right For You.

It’s never the wrong time to buy if:

- You have a healthy downpayment and job security

- You see yourself living in the home for the next 5-10 years.

- You can afford the monthly payments + contingency $

- You have lifestyle needs that aren’t being met by your current housing situation