If you’re a Buyer looking for a condo in Toronto, you’ve undoubtedly noticed the wide range of condo fees/maintenance fees in this fair city. Today we’re going to look at condo fees – what they are, what’s included and how they differ.

What is a Condo Maintenance Fee?

Condo maintenance fees are paid by all condo owners and are usually representative of the percentage that you own – the bigger your condo, the higher your maintenance fees. While there are a few condominiums in Toronto that make everyone pay the same amount of maintenance fee irrespective of size, most condo fees are based on the actual square footage of the unit – for example, $0.60 per square foot. As a condo owner, other than your own actual unit, you also own a percentage of the hallways, the lobby, the gym, etc., known as the “common elements”. Condo maintenance fees go towards paying the operating costs of the common expenses and elements. This generally includes:

- Maintenance and repair of common property – landscaping, repairs to the lobby and hallways, upkeep of fitness equipment, etc.

- Operating costs including garbage removal, heat, electricity and water

- Contingency reserve fund – part of every monthly fee goes towards the reserve fund – the rainy day fund to deal with unexpected costs, repairs and replacements. The minimal amount that must be contributed to the reserve fund is legislated by the government.

- Management and staff costs – property management fees, concierge, security, etc.

- Condo insurance – because you generally only own the space inside the drywall, your insurance only covers fire or damage to your own property. Part of the condo fee goes towards paying the bigger insurance that insures the common areas, the pipes and electrical behind the drywall and the overall building.

How Condo Maintenance Fees Differ

Condo fees vary widely – in Toronto, we regularly see condo fees ranging from $0.50/sqft to over $1/sqft. Generally:

- The older the building, the higher the condo fees; as buildings age, the roof is replaced, the lobby is updated and things break down.

- The more facilities and staff, the higher the condos fees; concierges don’t come cheap, and neither does maintaining a pool.

- The smaller the building, the higher the condo fees; this comes down to basic math – if the concierge’s salary is divided by 600 people instead of 30, everybody’s share of the cost goes down.

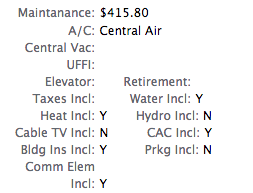

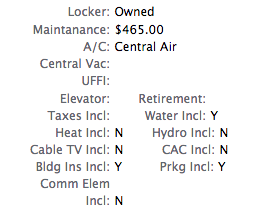

One of the other big differences involves utilities for the individual units: some condos include heat, hydro and air conditioning while others do not. Here are two examples from MLS, one where heat and air conditioning (CAC) are included in the condo fee, and one where they are not:

Why do maintenance fees matter?

Condo maintenance fees are real dollars that are a big part of your monthly carrying costs. They’ll go up every year – generally a few percentage points, so make sure to budget for that. If you’re looking at buying a newly constructed building, expect them to increase substantially in the first few years as the real costs of operating the building become known.

When you buy a condo, any expected increase to the maintenance fee is disclosed in the status certificate – a document that should be reviewed by your lawyer, explaining what you own, confirming what the condo fees cover and providing some insight into any extraordinary condo fee increases or decreases.

Related: Understanding the Status Certificate

Should I just buy a house instead of a condo?

Should I just buy a house instead of a condo?

Don’t fool yourself – it’s always more expensive to live in a house than a condo. With a house, you’ll still have to pay water, garbage, utilities and insurance and if you need a new roof, well that $10,000 is coming out of your own pocket. At least with condo fees your overall risk is spread out to all the owners and you have a predictable monthly amount to pay.

Related: Is it Better to Buy a House or a Condo?

As a condo Buyer or owner, it’s important to understand what your maintenance fees cover. For more information on buying a condo, check out: