It’s May 16th, 2013, and we’re still licking our wounds from getting our butts kicked in a couple of bidding wars this week. I’m talking the kind of butt-kicking where your client offers $120,000 more than the asking price and still gets beaten by $80,000 in a 13-person bidding war. Or when a $450,000 house with a 66 foot long wide sells for more than $102,000 over asking in a 6-person bidding war. Yes, folks, it’s that time of year again when Toronto Buyers swarm the small supply of houses for sale and the CBC starts calling.

It’s May 16th, 2013, and we’re still licking our wounds from getting our butts kicked in a couple of bidding wars this week. I’m talking the kind of butt-kicking where your client offers $120,000 more than the asking price and still gets beaten by $80,000 in a 13-person bidding war. Or when a $450,000 house with a 66 foot long wide sells for more than $102,000 over asking in a 6-person bidding war. Yes, folks, it’s that time of year again when Toronto Buyers swarm the small supply of houses for sale and the CBC starts calling.

I decided to pull some statistics to really see what’s really happening in the markets I primarily work in, roughly High Park to the Beaches and East York (also known as C1, C8, E1, E2, W1 and W2), south of Bloor/Danforth.

Houses Sold May 1 – 15

Houses sold: 161

Mean list price: $731, 521

Mean sold price: $763, 632

(*30 houses also Sold Conditionally during this period, but given those sales aren’t firm yet/prices public, they aren’t included in my data).

Digging Deeper into the Sold Statistics

67% of houses sold at 100% of asking price or more

42% of houses sold at 105% of asking or higher (5% more than asking price represents $36,576 in cold hard cash on the average listing price)

27% of houses sold at 110% of asking or higher (10% more than the average asking price represents $73,152 of cold hard cash on the average listing price)

13% of houses sold at 120% of the asking price or more (20% more than the average asking price equals $146,304 in cold hard cash on the average listing price)

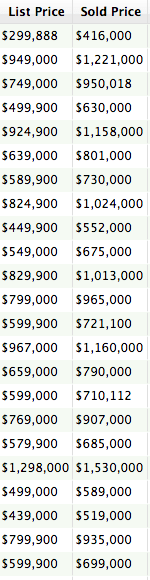

What does that mean in real numbers? Here’s a screenshot of some of that sold data:

But wait…it’s different with condos.

We continue to experience a schizophrenic real estate market in Toronto and condo sales numbers look very different. In the same neighbourhoods for May 1-15, 2013 (and once again, not including conditional sales):

70% of condos sold UNDER the asking price

16% sold at the asking price

13% sold over the asking price

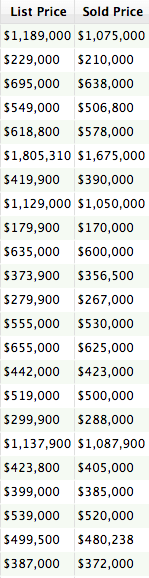

Here’s what that looks like at the bottom end, in real numbers:

A few things to keep in mind:

- We all know that Sellers manipulate asking prices to get attention, so a house that sold for 20% more than the asking price wasn’t really priced at market value. And neither was that condo listed by the Seller who thought he would try to set a new record high price for the building.

- This happens every year in Toronto – we see it for a few weeks in February/March, and again in May.

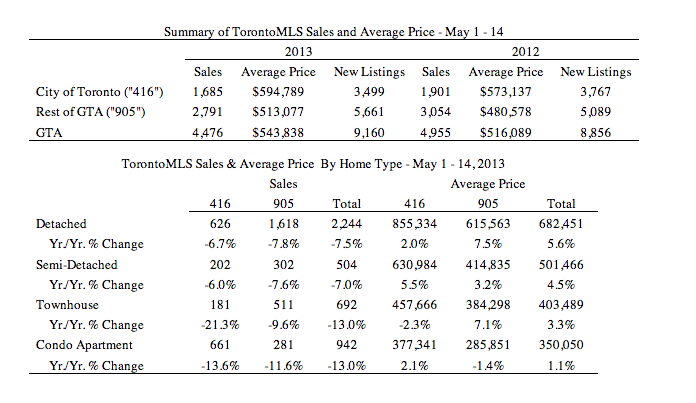

The official statistics were just released – not nearly as dramatic when you factor in the whole 416 area, but still good stats all around:

Mark says:

I’d argue that this statement isn’t actually true: “We all know that Sellers manipulate asking prices to get attention…”

It’s the selling agents that manipulate prices, not the home sellers. Most of them don’t know what they’re doing and count on the agent to do what’s best. It’s the agents that are pricing everyone out of the market with underhanded practices like this.