Looking to sell your investment property? We’ve written a detailed guide to help you understand your responsibilities and obligations as a landlord. Sell your property quickly, without compromising on price!

Tenant Rights & Obligations

In Ontario, tenants cannot be evicted because a landlord is listing their property for sale. If the tenant is in a lease, the new owner assumes the tenant; if the tenant is month-to-month, the new buyer can give 60 days’ notice of their intention to move into the property. Tenants cannot be made to move out in advance of a property sale.

-

- If your tenant is in a lease, the tenant has a right to stay under the Residential Tenancies Act. Even if the new owner wants to move in, the lease obligations transfer to the new owner, and so they cannot do so until the end of the lease term.

-

- If the tenant is month-to-month, the new owner may move into their space. A minimum of 60 days’ written notice (from the first of the month) must be provided to the tenant, along with one month’s rent compensation. The new owner (or an immediate family member) must occupy the space themselves—they can’t simply kick the tenant out and rent it to someone else.

-

- Showings and Tenant Cooperation – Provided 24-hour notice has been provided to the tenant, they must cooperate with the landlord for showings (whether they are in a lease or not). They cannot insist that they be home for showings, and do not have the right to dictate timing of showings. If they do not cooperate, the Seller can claim damages and/or proceed with an eviction.

Timing the Sale

When should list your tenanted property for sale? Should you list it while your tenant has a lease in place, at the end of their lease or wait until they give notice that they are leaving? Remember: under Ontaro’s Residential Tenancies Act, you cannot ask your tenant to leave simply because you want to sell.

Timing the sale of your investment property depends on a few factors:

- Your Target Buyer If your target buyer is an investor, the fact that there’s already a tenant in place and a known rate of return could benefit the buyer, so timing the sale with the end of a lease is less important. If your target buyer is an end user (in other words, someone who will move into the unit themselves), then you’ll want to time the property listing towards the end of their lease. Remember that once an agreement of purchase and sale is in place, you can then provide 60 days notice to the tenant (from the 1st of the next month) on behalf of the new buyer, if they (or their immediate family member) will be moving into it. For example, if the lease ends on June 30th, you could give notice on behalf of a new buyer as late as May 1st. If condos in your building take an average of 30 days to sell, then you’d probably want to target a listing date of no earlier than April 1st. That way, your tenant would be on a month-to-month lease by the time of closing, allowing you to target effectively both investors and end-users.

- Your Goals Your personal financial goals need to be considered when timing the sale of an investment property. Do you need the equity for other purposes? Is your mortgage up for renewal? How would a sale affect your taxes?

- The Market What’s happening in the real estate market? Are values in your building or neighbourhood increasing or decreasing? Should you lock in your returns and move on? What’s happening to interest rates?

PRO TIP:

If you’re thinking of selling an investment house or multi-unit dwelling soon, don’t sign new leases. You’ll get a higher price for your property if you are targeting both investors and end-users who want to live in one of the apartments themselves. Having a vacant apartment—or at least tenants who are month-to-month—is an attractive feature for many buyers.

Always increase your rents every year. The amount of rent your tenant pays will directly impact the sale price of your house. Because the lease transfers with the property, a tenant who is paying below-market rent will mean the new owner will take in less income than they would with a comparable property, and that will make your house less valuable (read: lower price). Always charge market rent to a new tenant, and always increase rents annually by the amount allowed by law. Have a great tenant you want to reward/hang on to? Find alternative ways to sweeten their deal that don’t change the base rent you are charging.

Hiring a REALTOR

The real estate agent you choose to hire to sell your investment property matters—in fact, it might be one of the biggest factors impacting how much you sell for, how long the property is listed for sale, and your overall experience. Hire the right REALTOR, and you’ll benefit from a fast sale and a great price. Hire the wrong one and expect to pay in time, aggravation and money.

When selecting an agent to list your investment property for sale, look for:

1. Experience selling the type of property you own – Selling a house is very different from selling a condo, so make sure the agent you hire understands the intricacies and unique challenges of Toronto houses and condos.

2. Experience working with investors and selling tenanted properties – Hire someone who understands investment math and ROI and can analyze your property like an investor. You’ll want someone familiar with the legal and tax implications of selling an investment property, and someone with proven experience building relationships with tenants.

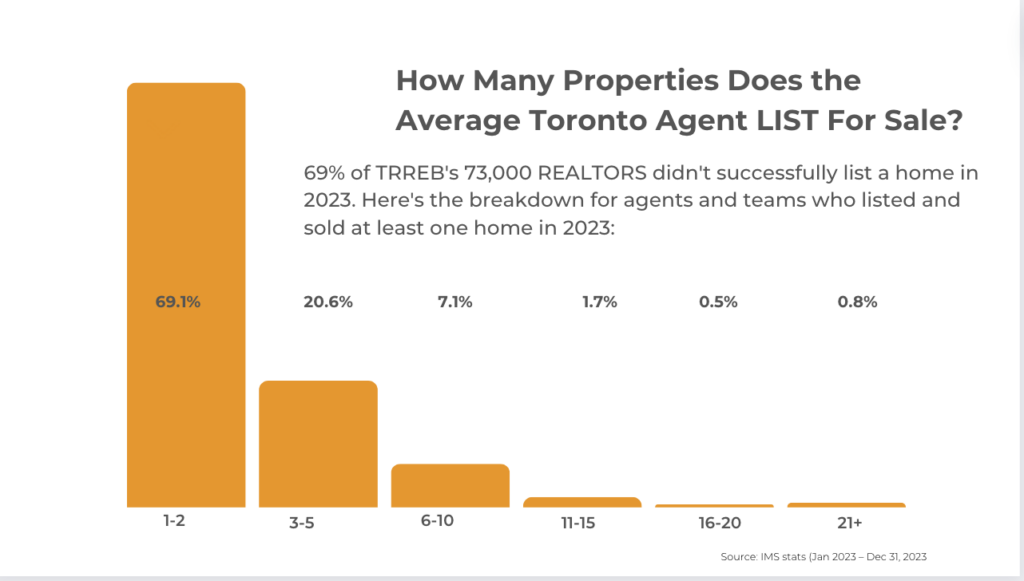

3. Listing expertise – Ontario real estate agents are licensed to help both buyers and sellers, but the skills needed are very different. When interviewing agents, ask how many homes they’ve LISTED for sale. In 2023, 69% of Toronto REALTORS didn’t successfully list a single home for sale.

4. Familiarity with your neighbourhood – A listing agent isn’t just selling your house – they’re selling your neighbourhood too.

5. Services and inclusions that matter to you – Some REALTORS include professional cleaning, staging, HDR photos, floor plans, videos, 3-D tours, and more in their commission, while others offer more basic services.

6. Marketing acumen – There’s so much more to marketing a house than listing it on the MLS. Hire an agent who has proven they can reach potential buyers online and on social media.

7. Advanced skills in pricing, negotiation, and strategy – They don’t really teach this in real estate school, and these skills will make the biggest difference in how long your home takes to sell and the price you get.

8. Communication skills, responsiveness and availability – Selling an investment property can be stressful. You can reduce the pain by hiring a REALTOR who prioritizes communicating how and when you want to be communicated with.

Remember, you get what you pay for. Real estate services come in all shapes and sizes: you can list your property on MLS for $150 and do everything yourself; you can list with a discount broker who provides limited services; or you can list with a full-service broker and get the staging, marketing, expertise and strategy that comes with higher commissions. Decide what you need, what you’re prepared to pay for, and pick accordingly.

Remember: Your REALTOR Is On Your Side.

Related: Discount vs. Full-Service REALTORS: What’s the Difference?

Related: 15 Big Questions to Ask Before Hiring a Listing Agent

Costs to Sell

Home Preparation – variable

Cost varies depending on what you decide to fix before listing it for sale.

Staging – $0 (if tenanted)

Unless your tenanted property is vacant, you likely won’t be able to stage it.

Home Inspection or Status Certificate – $100-$700

We often recommend that house sellers get a pre-listing home inspection before they put their property up for sale. This gives sellers the opportunity to proactively fix any issues with the house before it hits the market or factor the cost of those issues into the asking price.

If you’re selling a condo, you’ll need to provide a status certificate to the buyer/their lawyer/their lender.

BREL tip: the person with the most information almost always wins a negotiation

Note: When you list your investment property with the BREL team, we pay for a pre-list home inspection or status certificate. We consider it an important part of our pricing strategy and a critical part of marketing the property to prospective buyers.

Real Estate Commission – variable

The biggest selling cost is the commission paid to real estate agents. The commission is usually split between the…

- Agent who works for you, the seller (aka the Listing Agent)

- Listing Agent’s brokerage

- Agent who brings the Buyer (aka the Buyer’s Agent)

- Buyer Agent’s brokerage

In Toronto, we find many service and commission options, ranging from 1-6%. The commission an agent charges depends on their experience and expertise, the services they offer (professional cleaning and staging, HDR photography, floor plans, videography, virtual tours, digital marketing, print marketing, etc.), and the amount offered to the agent who brings the buyer.

Note: At the BREL team, our business model of ‘All-in Pricing’ means that our commission includes the primping, prepping, staging and marketing necessary to get our sellers the highest price. If there’s a tenant in your property, and we can’t stage it, you’ll get a discount on our usual commission. You can read more about our commission options here.

Legal Fees – $1,200-$2,000

Legal fees for selling your home depend on the law firm you choose and the price of your home. For a quick online quote, check out one of our favourite lawyers’ websites, Feld | Kalia.

Mortgage Penalty – $0-$10,000+

If you have a mortgage, your lender may charge you a penalty if you sell during the mortgage period. Most banks allow you to apply the remaining mortgage balance to the mortgage of a new property (provided you purchase the new home within 90 days of closing), but some mortgages have restrictions. If you’re selling your home and not buying a new one, you will likely have to pay a pre-payment penalty, which might be thousands of dollars. Make sure to talk to your lender before you list your house for sale.

Taxes

Be prepared to pay capital gains tax when you sell your investment property. You can read all about taxes here.

Good news: the buyer is responsible for paying land transfer taxes, so that’s one cost you won’t have to budget for!

Other Costs – variable

Before closing, your lawyer will give you a full breakdown of any other selling costs, which may include outstanding property taxes, utilities, etc. The seller is responsible for these costs until the closing date, so if your closing date doesn’t align with the date you normally pay these expenses (usually doesn’t), you’ll be responsible for paying the partial month’s costs.

If your tenant is month-to-month and the new buyer is moving in themselves, you can give the required notice on behalf of the new owner – just make sure it’s clear who is paying the one month’s rent compensation (you or the new owner).

Staging Your Investment Property

As a landlord, you don’t have the right to stage your tenant’s apartment. You can’t force your tenant to rearrange their furniture, take down their personal photos or even keep it clean. Of course, how well a property is presented impacts price and how long it takes to sell. Here are a few strategies for getting cooperation from your tenant:

-

- You do have the right to repair anything that isn’t working, and you can paint the walls, change the light fixtures, or wash the carpets.

-

- In our experience, most tenants are amenable to their landlord sending in a cleaning service before the property gets listed – who doesn’t want someone else to clean their home?

-

- Having a good relationship with your tenants or allowing your real estate agent to build a positive relationship with them will go a long way towards helping the sale. Happy tenants will be more open to de-cluttering and preparing their apartments. A fast sale is also to your tenants’ benefit.

Read: If your investment property is vacant, Selling a Vacant Home.

Marketing a Tenanted Property

It can be more difficult to market a tenanted property. Depending on your tenant (i.e. if they are messy), photos might work against you. Tenants are often not very cooperative with open houses, so reaching potential buyers can be more difficult. A good agent will market your home online and have a pool of investment buyers they are working with to overcome some of the marketing challenges of selling a tenanted property.

Related: Find out How We Market a Property for Sale

Showings

In Ontario, you have a right to show the property to potential buyers between 8 AM and 8 PM, provided appropriate notice (24 hours) is given. While it may not be convenient for a tenant, it is your right. Don’t let your tenants bully you into super restricted showing times. A cooperative tenant will shorten the time it takes the property to sell.

Ideally, your tenant will leave their apartment during a showing, but again, this isn’t something you can require. We’ve shown properties where hungover tenants stayed in bed during the entire showing! A simple request from you (and perhaps a small gift or concession for goodwill) might resolve this obstacle.

Note: If your tenant has already given you notice that they will be leaving and ending the tenancy, the Residential Tenancies Act only requires that the landlord make reasonable efforts to provide notice of a showing, but the 24-hour rule does not apply.

FAQ for Landlords Selling an Investment Property

I just signed a 12-month lease a few months ago. Can I sell the property?

Yes! Note that the Residential Tenancies Act requires that the new buyer assume the tenant and the lease – at the end of the lease, the new buyer may then give 60 days’ notice (and one month’s rent) to vacate if they want to occupy the property themselves.

Can I take photographs of the property for marketing purposes?

Yes, you have a right to take photographs. However, interior photos that include a tenant’s personal belongings are contentious, and some courts have ruled that this infringes on their privacy rights. This is one of those times when it pays to have a good relationship with your tenant! In any case it’s always good practice to ask the tenant to remove any personal belongings they don’t want to be photographed in advance of the photographer’s arrival.

I want to do some renovations before selling my investment property. Can I evict the tenant?

Likely not. Rules about renovating are complicated and the tenant usually has the right to move back into the property after renovations. You should contact the Landlord Tenant Board for guidance.

Can I pretend I am moving into the unit myself to evict the tenant and then put it up for sale?

This is a serious violation under the Residential Tenancies Act. Bad faith evictions come with penalties of up to $50,000.

My tenant doesn’t want showings before 11 AM or after 6 PM. What should I do?

The tenant’s obligations require cooperation for showings between 8 AM and 8 PM. You can choose to work with your tenant if there’s a valid reason for their request (eg – they work until 5 AM and sleep until noon) – but you are under no obligation to be flexible. If the tenant has already given notice of their intention to vacate the property, you do not even have to give 24 hours notice of a showing – but you do have to let them know.

At very least, some compromise on the timing of showings could be useful to show goodwill and provide incentive for the tenant to be flexible in other ways, such as keeping the unit clean or leaving during showings.

How do I evict my tenant so I can sell my property?

Under Ontario laws, you can not evict a tenant or ask them to move out. The new buyer inherits the tenant and the lease. If the tenant is month-to-month (vs. in a fixed-term lease), the new buyer can provide 60 days written notice if they are going to occupy the home themselves. In these cases, the Seller often provides the required notice on behalf of the new Buyer.

My tenant is in a lease and I just sold the property. Do they have to leave so the new owner can move in?

In this situation, the terms and conditions of the lease transfer to the new owner, and they assume the landlord’s responsibilities. This means that:

- The new owner will be the landlord when they take possession of the home

- The tenant will pay rent to the new owner

- The tenant’s last month’s rent deposit will be transferred to the new owner

- The tenant’s rights and responsibilities under the lease remain unchanged for the full duration of the lease.

At the end of the lease, one of the following 3 things can happen:

- The tenant becomes a month-to-month tenant (meaning that they can provide 60 days’ notice of their intention to leave); the terms of the original lease remain in place

- The tenant and new landlord agree to sign another lease

- The new owner can provide the tenant with 60 days notice of their intention to move into the home for their personal use.

My tenant is a month-to-month tenant, and I have sold the property. What happens next?

One of 3 things can happen:

- Nothing changes. The new owner assumes the tenancy and the last month’s deposit is transferred to them; everybody’s rights and responsibilities remain unchanged.

- The tenant and the new landlord can choose to sign a new lease after the closing.

- The new landlord can give 60 days’ notice of their intention to move in and compensate the tenant with one month’s rent. Note that the current landlord can provide that notice on behalf of the new owner if this is happening before the sale has closed.

I sold my tenanted property and the new owner wants to move in. What do I need to know?

Under Ontario’s Residential Tenancies Act:

- You can provide the required notice (60 days) to the tenant on behalf of the new landlord.

- The notice must be given on the N12 form

- You must provide the tenant with compensation equal to one month’s rent (paid before the end of the lease)

- The person moving in must be the new owner or their immediate family member (parent, child or spouse)

- A landlord cannot act in bad faith. In most cases they must live in the unit for at least 12 months if they evict the tenant for personal use.

What does ‘cash for keys’ mean?

‘Cash for keys’ is a common term used when a landlord and tenant reach an agreement to do something that falls outside the rules of the RTA.

For example:

A landlord wants a tenant to leave before they list the home for sale. Because this isn’t permissible under the RTA, a landlord may approach a tenant and offer $$ in exchange for the tenant agreeing to leave.

In these cases the amount of ‘cash’ offered in exchange for ‘keys’ varies depending on the situation and is negotiated between the landlord and tenant. The tenant will have to consider the costs to move and the difference between what they are currently paying in rent and what they will have to pay in the current market, while the landlord will need to consider how much they think they can profit by selling the home vacant.

Selling with BREL

Here are a few of the reasons to consider selling your investment property with the BREL team:

- We’ve listed and sold a LOT of properties – our expertise has been honed by facilitating over 2000 transactions and over $1 billion in real estate sales.

- Our reputation precedes us – we have 750+ 5-star reviews ⭐️⭐️⭐️⭐️⭐️ (you can read them here)

- Our results speak for themselves. In 2023, BREL listings sold more than twice as fast and for an average of $10,969 more than the average home listed on the TRREB MLS.

- We know investment properties. We’ve been helping landlords for a long time and understand the unique challenges of selling investment properties. We’re well-versed in the legal and financial implications and have a solid track record of building positive relationships with tenants and gaining their cooperation.

- Nobody markets a house like BREL – Digital marketing isn’t new for us; it’s been at our core since day one. You’ll find us on Facebook, Instagram and TikTok – and more than 75,000 people visit our website monthly.

- All-inclusive commission – We’re transparent about our commission and offer a discounted commission if we are not staging the property.

- We’re responsive and available – We pride ourselves on being easy to reach and quick to respond. We know that selling a home can be stressful – we’re here to answer your questions and provide guidance whenever you need it.

- Pricing and negotiation – We’re really, really good at this. Every BREL agent is a Certified Negotiation Expert.

- Bespoke service – We know that no two sellers are alike, so we tailor our services to meet your unique needs.

- No BS – It’s not just part of our slogan – we pride ourselves on being upfront and honest with our clients.