For months now, we’ve been anticipating changes at the provincial level to cool the hot Toronto real estate market. Today (April 20, 2017), as part of the Fair Housing Plan, sixteen measures were announced – an odd mix of tax grabs, easy targets and tricks.

In short? This isn’t going to crash the Toronto market. It might slow things down a bit, so I don’t expect we’ll see another year of 33% increases (thankfully), but I don’t think we’ll see prices go down either. A more balanced market is good for everybody.

Here’s the lowdown on what was announced.

- A Non-Resident Speculation Tax (NRST) of 15% on home purchases by non-Canadian citizens, non-permanent residents and non-Canadian corporations in the Greater Toronto Horseshoe area, including Peterborough to Barrie, Waterloo and Niagara to the US border. It appears there will be quite a few exceptions to the NRST, including students enrolled in college or university for at least 2 years and someone buying a property with a Canadian resident or citizen. Also important: people who become residents within 4 years of the purchase would be entitled to a rebate of the NRST. The NRST is applicable on all purchases entered into agreement after April 20th, 2017. (full details of the Non-Resident Speculation Tax here)

- As I’ve said before, I think this is a small percentage of the Toronto market and I don’t expect the Non-Resident Speculation Tax will have a huge impact on prices. It’s easy to tax the people who don’t get a vote – but they are rarely the ones bidding up house prices by hundreds of thousands of dollars during a bidding war. Some areas of Toronto and the pre-construction condo market will likely be affected, but I don’t expect this to be a particularly long-term impact on the market as a whole.

- Changes to make the rental market friendlier for tenants, including rent control for all buildings, irrespective of construction date. (Currently, buildings built after 1991 aren’t subject to a maximum annual rent increase). Rent increases for all buildings will be set by the province and capped at 2.5% This change is effective today but has to be approved through legislation. They also announced a standardized lease document for all tenants and more rules for landlords.

- The 1991 rule always struck me as odd, and as someone who works with a lot of investors, I think it’s been mostly used to evict bad tenants as opposed to encourage investment purchases. I don’t think this will impact the frenzy in the market.

- REALTORS use a standard lease document already and if people are putting in illegal clauses, well, that should be stopped.

- More oversight on assignments (or as they call it, ‘paper flipping’). Assignments happen when a buyer (usually of a pre-construction condo or house) assigns their agreement of purchase to another buyer before actually taking occupancy.

- Not much clarity as to what this actually means yet, but I suspect they might make the original purchasers pay land transfer tax and will finally have a way to ensure the original purchasers are paying capital gains tax on any profit. This will hurt the people who buy pre-construction condos with the intention of taking advantage of this loophole….but again, I don’t see this having any real impact on the market as a whole. Also: I’ve always hated this loophole and I’m glad they are addressing it.

- Changes to encourage builders to build rental apartment buildings, including a rebate of the development cost charges and requirements to keep municipal tax rates more in line with residential tax rates.

- We need more rental stock in Toronto…though I suspect this might backfire and result in less new condominiums being built, which would drive up prices.

- New reporting requirements that will allow the government to track citizenship, residency, and the purpose of the purchase (eg to live in or rent out).

- Yay! I look forward to the government having real data to facilitate decision-making.

- Identifying provincially owned surplus lands that could be used for affordable and rental housing development (West Don Lands, 27 Grosvenor Street, 26 Grenville Street).

- I’ll believe it when I see it.

- Allowing Toronto to tax vacant homes and lands

- I can’t see that this will have much effect on an investor’s decision to buy or sell – they are already paying property taxes and maintenance on vacant units, so I suspect this will have no effect on the market and is just a tax grab.

- A review of the rules governing the conduct of real estate agents

- Yes, yes, yes! This is long overdue. I’d love some real rules for bidding wars and an end to the practice of one agent representing both a buyer and a seller on the same transaction. I wrote about that here and here. BUT!!!! I have no idea why this was included in today’s announcement…the issues with ethics and realtors doesn’t relate to house prices.

- Some other smoke and mirror stuff, about creating a Housing Supply team, educating consumers about their rights, establishing a Growth Plan to look at density, creating an advisory group and a whole thing about elevators (wth?).

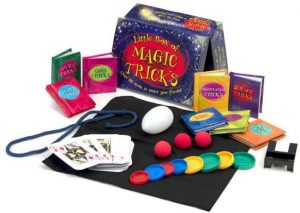

My Conclusion: The Ontario government wants to be seen as doing ‘something’, and in an effort to gain some popularity (they need it), they introduced a mixed bag of tricks that will only have a minimal impact on the market. Going after easy tax grabs and easy targets (realtors and foreigners) don’t strike me as great policy.

Is it a good time to buy in Toronto? Yes.

Is it a good time to sell in Toronto? Yes.

A more balanced market is good for everybody.

David says:

Great (fair) summary – thank you!

Elevator reform is next!